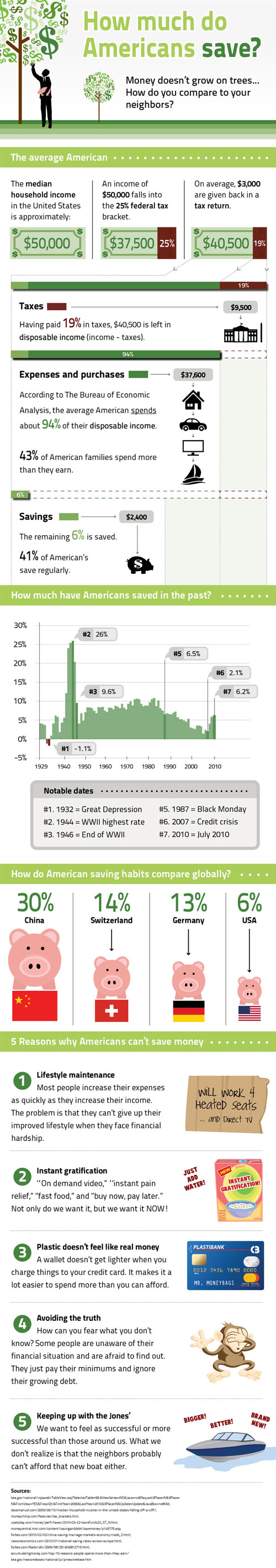

How can I save money?

Americans financial statistics

Avg. American savings balance

| $3800

| |

|---|---|---|

% not saving for retirement

| 40%

| |

Percent of American families who have no savings at all

| 25 %

| |

Average credit card debt

| $2200

|

Numbers courtesy of http://www.statisticbrain.com/

How to save money

How to save money

In a struggling economy one of the hardest things to do is to learn how do i save money. With all of the ads, half off sales, and of buy one get one sales going on we often avoid ways ways of saving money. We have to use self discipline when it comes to saving money, and understand how do you save money can benefit us. Our nature is if we see it and we like it, then we have to have it. How can we allow ourselves to buy a cup of coffee every morning, but not set the same amount of money aside to save money for a rainy day. In a report done by statisticbrain.com the average American family saving is about $3800, but there are also about 25% of Americans who do not have a savings account at all. The report also showed that only about 38% of Americans have emergency funds to fall back on. Ask yourself this question, if you lost your job today do you have enough money to survive until you found another one. What I'm going to be giving you today are some ways to save money, frugal living ideas, and strategies that I did not always follow, but once I did it changed my life forever.

First things first, in order to start to save money you must develop a strong willpower to say no. With the constant advertising that you are hit with on a daily basis, you must resist the temptation to buy unnecessary items in you day to day life. The spontaneous but is one of the top things stores count on to make sales. They put candy and drinks at the checkouts to attract you or you kids to buy a little something extra that you may not be counting on. At the end of the day it all adds up.So how do we save money? In order to save money you must cut down on some of your spending. Take a look at your month to month bank account and see if there are some constant items that you may be able to do with out, or cut back on. We have to reverse our mind frame from constant spending to save money. If there are some shoes or an outfit that you have been looking at, check online and see who has that item at the lowest price. Make it a game with the whole family, and see who save money each day. These are some great ways to get started on the right path. So you may ask where to save money, check below for some fresh ideas.

Next we are going to look at setting up an automatic saving plan to help the stress of saving money. Most of you have had jobs that offer 401k benefits, and hopefully you guys are using them toward your future. The money comes directly from your pay and is set aside for your retirement. You can also set this strategy for your short term savings goals as well to save money. Try setting up a couple of extra savings accounts, and have a small amount direct deposited into these accounts from your paycheck. Start to save money first with an emergency fund account, which will be for if things were to get tight, or you were in between jobs, you would have something to fall back on. If it's nothing but $10 or $20 each check, it still is a great way to save money.

Next think of setting one up as a car fund, just in case something were to go wrong with your car you would have money set aside for that. Let's face it most times you may not know that there is something wrong with our cars until it won't start. Car repairs can be a major set back if you are not prepared for them. Let's also take a look at choosing to get a new car. As a car owner there is no bigger moment than when you pay off your first car. You have extra money now to spend, and to have financial freedom, but there is still the opportunity to save money. Let's say that while you were still paying on you car note your monthly payments were $300 a month. What if after you paid off your car decided to keep paying the $300, but toward paying yourself. I mean face it you have been paying this money all this time why not use it to pay yourself and save money at the same time. That's $3600 a year and in four years that's $14,400 to do what you may, or be a great down payment on another car. Pay your self first that's how I save money.

Save money for retirement

Because of the lack of many jobs that offer a steady pension plan, it's up to most Americans to save money to provide their own retirement plan. If you job offers 401k I would suggest that you enroll in it right away. 401k is a great way to save money for the future because it comes out of your check before taxes so you will not even miss it. You should try to invest somewhere between 5%-10% per pay period. So how much money should you invest in the future, think of how much you spend a month now and add 10% for inflation, this will be a good measure of what you will need when you retire. If you need help you can check out quicken.intuit.com for even more help on what you will need for the future. If your job does not offer 401k think about opening a Roth IRA account(rothira.com). The great thing about this option is that when you retire you can get your entire investment tax free.

Saving for college

For a new baby you would have to save $180,000 to send that child to a four year university, and $360,000 for a private university. First things first you will want to figure out how much you are willing to set aside. With so many grants, scholarships, and student loans out there, your plan can be adjusted on the fly. As someone once told me you can barrow to send your child to school, but not to retire so choose wisely. You can open up a 529 college saving account which is allot like 401k. The money that you invest into this account is split up into mutual funds, stocks, and bonds in an effort to get you a max return for you investment, and best of all the money is federal tax free. Another great way to save money is to take advantage of the 529 account is that you can set aside about $300,000, and best of all anyone in the family can contribute to the fund. And if your child doesn't go to college you can use the fund on another child, or use it use it for yourself. Check out http://www.collegeadvantage.com/open-an-account for info on how to set up an account.

I hope that these tips have been helpful to you as they were to me. Saving money is one of the hardest things that I have done, but by following these tips it made saving money easy. Always save for a rainy day, and save for the unexpected.

how can you save money

- video games

Find the latest video games and accessories at budgetbuyz.net. Shop for Xbox 360,Ps3,Wii games, and more. Earn up to 3% cash back from your total purchases when you shop with us. "Prices so cheap they can't be beat. - Please Review these Tips - Saving Money on Electrici...

With the rising costs of electricity, people are becoming more and more concerned about saving money on their electric bill. As people become more aware of the environmental impact they are having on the planet, they are becoming more willing to try. - Saving Money on Groceries with Bulk Food Shopping

Bulk food shopping is a great strategy for saving money at the grocery store. Learn how buying in bulk will help you to more frugally spend at the grocery store. - How to Start Saving Money for A Car

Saving money for a car could become quite a task. There are several factors that are useful when it comes to saving for a car. One must first consider the price of the car in question. For most of us financing is an option; however when... - TOP THREE WAYS OF SAVING MONEY

Top three tips of saving money are shopping tips,live green and money saving with energy saving. Actually to save money we need to change our patterns of living than it is possible to save money.A penny saved is a penny earned. - The art of bargain shopping for appliances

Bargain shopping for appliances can be very fun and easy. White goods can be found for a great low prices.